Leadership typically assesses the value of a possible merger or acquisition based on business strategies such as:

- Gaining entrance to new markets

- Filling solution offering gaps and building solution synergies

- Accelerating scale and improving cash flow

Yet, despite these well-intentioned strategies — and the due diligence of leadership in their assessment within these parameters — the failure rate for most mergers and acquisitions (M&A) remains greater than that of their successes.

Between 70% and 90% of mergers and acquisitions fail.

- Lake Capital Partners and Harvard Business Review research

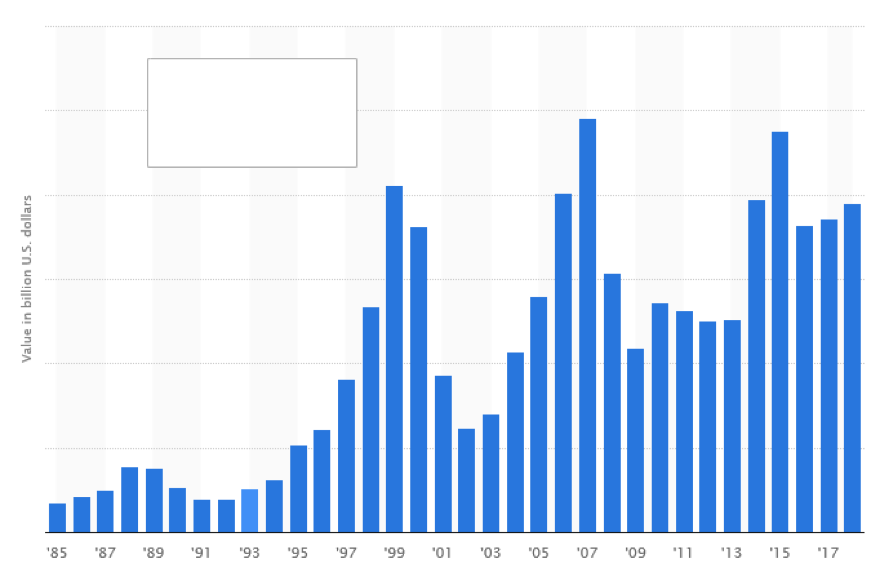

Despite the trend of failure, the rate and size of acquisitions has more than tripled since the late 1980s and early 1990s, with the total value of mergers and acquisition deals worldwide now estimated at $3.9 trillion (2018).

Even with substantial resources being invested in mergers and acquisitions by businesses around the world, many are failing. It is more important than ever to understand where this failure stems from and how to overcome it for all future deals.

Why Mergers and Acquisitions Are Failing

Research indicates that most mergers and acquisitions failure results from:

- Inadequate due diligence and oversight of key issues

- False sense of security around promised/expected solution synergies

- Failure to recognize cultural synergies and differences

While the above points do hold merit and would affect the success of a merger or acquisition, in our experience at Mereo, failures or even sub-optimal successes generally occur for the same reasons businesses underperform: a lack of alignment across sales, marketing and product strategies.

The Key to Merger and Acquisition Success: Alignment

Due diligence should not be simply a financial exercise. It should extend to identifying synergies and differences in the sales, marketing and product functions between the two organizations in order to realistically determine if the differences can be overcome and the opportunities leveraged.

SALES

- Can one of the joined entities help position new solutions to new markets (e.g. geographies, industries, size)? Will the execution model accelerate or hinder this opportunity?

- How consistent or different are sales practices of the combined organizations? What impact will that have on quickly aligning the teams?

- How similar are the compensation plans of the combined organizations? If one structure is based on revenue acceleration and growth (higher compensation based on increasing quota achievement) and the other is founded on revenue predictability (reward and compensation maximized for achieving quota with downside pressure for significant over- or under-achievement) then there is significant risk of frustration and turnover at minimum.

MARKETING

- How aligned are the marketing strategies of the combined organizations? For example, is one focused on creating demand based on brand awareness while the other drives demand with active programs, campaigns and activities?

- If there is a mismatch, ask yourself: What will the effects be on sales’ skills and tools?

- A change in marketing spend mix or focus as compared with history may have a detrimental and unexpected effect on sales performance and result in turnover and tools/skills investments not forecasted.

PRODUCT

- Is product strategy driven by customer and market input or is it driven by expertise internal to the company?

- If the customer base is accustomed to being integral to the strategy and investment decisions, will the decrease in engagement cause dissatisfaction? What are the customer’s expectations and how will you continue to engage them or initiate engagement if you have not in the past?

- What product strategy will best inform your newly joined organizations’ strategy and investment decisions?

An Advantage in Achieving Alignment

At Mereo, we help companies define sales, marketing and product strategies with tools and techniques that create a particular focus on the alignment of strategies across the entire organization and each function. Let’s connect to see how leading practices we have employed to successfully help leading B2B organizations align their teams for sustainable revenue performance might be relevant for your situation.