Business regulations and compliance requirements continue to expand across all geographies and industries. In the United States alone over the last 10 years, more than 30,000 new federal regulations have gone into effect — equating to more than 750,000 pages added to the Federal Register (Competitive Enterprise Institute).

Most recently and notably the General Data Protection Regulation (GDPR) went into effect in May 2018, impacting all businesses that process the data of European citizens, with non-compliance penalties of up to 4% of revenue. The European Parliament adopted a revised payment services directive (PSD2) in December 2015, promoting development and use of innovative online and mobile payments through open banking. Likewise all around the globe a small sampling of new regulations show this trend is accelerating and worldwide:

- Australia implemented a New Payment Platform (NPP), affecting financial services.

- The US Office of the Comptroller of the Currency (OCC) invited Fintech companies to apply for special national charters, providing a path towards becoming a bank.

- In the US, the Health Information Trust Alliance, or HITRUST, in collaboration with healthcare, technology and information security leaders, has established a Common Security Framework (CSF) including a prescriptive set of controls that can be used by all organizations that create, access, store or exchange sensitive and/or regulated data.

- Canada is in the process of reviewing the federal financial sector framework.

- Hong Kong is upon a new era in smart banking.

- India implemented the Unified Payments Interface (UPI).

- Japan made amendments to its Banking Act in 2017.

- Singapore developed the Finance-As-Service: API Playbook.

- South Korea implemented a Fintech open platform.

- The list goes on; it is pervasive and it is not slowing down soon.

In order to survive in this ever-changing and growing regulatory environment, business leaders and their IT partners must stay abreast of regulatory changes and drivers, as well as ensure they check all the compliance boxes — while at the same time proactively identifying and addressing vulnerabilities and responding quickly to even the slightest breach. Business leaders must be able to prove they have been compliant, they are compliant and they will be compliant through appropriate transaction recordkeeping, data lineage (traceability), monitoring and controlling processes, and informing audits — all while managing data, infrastructure and personnel costs effectively. The risk of failure to comply is nothing to scoff at: fines, penalties, brand devaluation, company and personal reputation and more pose the greatest risks. For instance, as of January 21, 2019, Google was penalized for 50 million euros by the French National Data Protection Commission (CNIL) in accordance with GDPR for infringing on essential principles of transparency, information and consent.

These business regulations may prove limiting for buyers — but they offer a unique situation for the B2B seller.

There is a substantial opportunity for informed sales teams to transform into informed business partners.

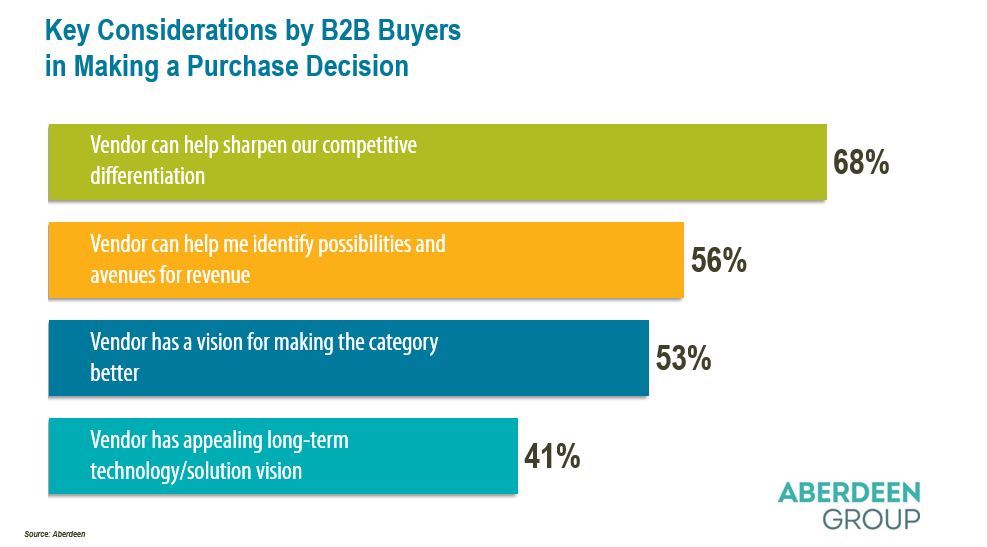

According to a recent study conducted by Aberdeen Group, B2B buyers seek out sellers who can sharpen their competitive advantage and have an appealing long-term technology/solution vision, among other things.

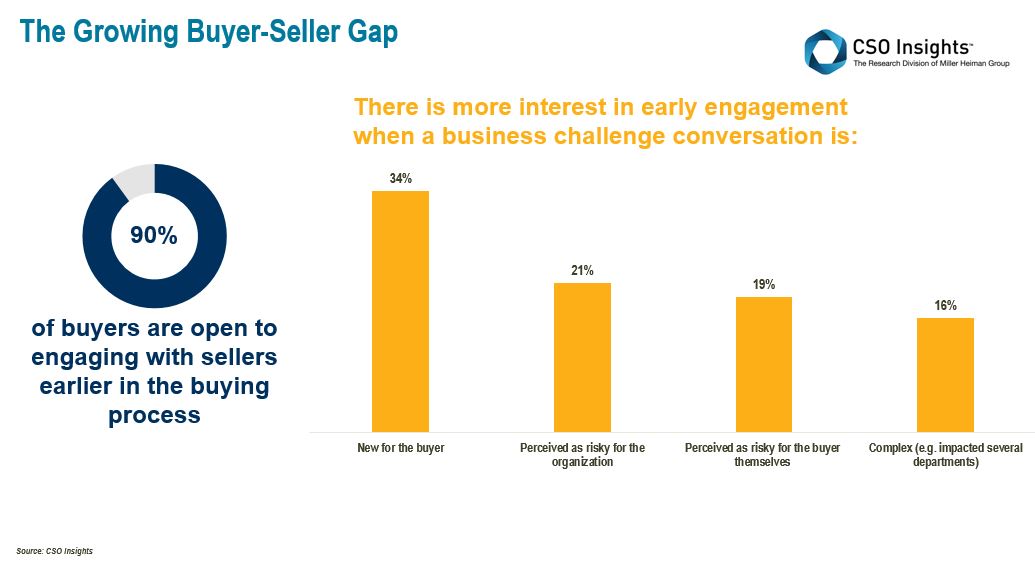

Yet, 30% of the time buyers are not engaging sellers until after they have identified and clarified their needs — and another 26% are not engaging with sellers until after they have identified a solution (CSO Insights).

There is a silver lining in these discouraging statements, however: 90% of buyers are willing to engage salespeople earlier in the buying process if the sales team is providing specific value (CSO Insights).

As such, with regulatory and compliance requirements growing in scope and complexity — compelling businesses to find solutions that enable them to comply with these regulations in a way that does not impede business strategy or break the bank — B2B sellers have an opportunity to position their value proposition in a unique business regulation framework.

Through this framework, sellers can become trusted partners to buyers.

In order to achieve this level of service, B2B sellers need to be viewed as knowledgeable and credible through the means of:

- Educating sales teams around relevant regulations, with their business impact and solution value in the context of the regulatory environment.

- Growing and maintaining a social media presence, sharing relevant thought leadership.

- Providing solutions that are validated, certified and approved where applicable.

- Attending trade shows and events with speakers who are at the forefront of relevant regulatory activities and compliance tools and processes.

- Developing assets such as references, case studies and process demos that help the buyer better understand what the regulations mean to the business and the value of the solution in context of helping the business adhere to business regulations.

- Engaging in sales conversations that put the client first — in a pain-solution-gain-proof framework.

For example, the VA at a location in Texas had outsourced its appointment mailers to a local printer unaware of the HIPPA regulations. The printer was mailing out patient and doctor details on postcards, which violated these regulations and could result in numerous fines, not to mention loss of credibility and trust with its patients. A well-informed seller stepped in, warning of the violation and providing its solution for compliance (sealed envelope). This seller instantly proved their value to the client and became a trusted source for their business.

Another company actually produced (in cooperation with their legal team) a summary of the new GDPR regulations with callouts to specific sections their solutions helped their customers address. This sales asset proved valuable to salesperson and prospect alike.

When salespeople are knowledgeable and credible in their buyers’ regulatory business environment, they will be able to engage buyers earlier with a higher level of interest, engage them in more meaningful conversations and position their solutions as serving these buyers’ needs in this environment.

If you are interested in discussing how your sales team can be better addressing your buyers’ regulatory needs, please contact us.