Pricing strategies are a vital part of the solution, financial and go-to-market elements of your organization. Pricing affects profitability at every level of your business, including gross profit and EBITDA (Investopedia). In fact, according to Profitwell, as little as a 1% improvement in price optimization can result in an average boost of 11.1% in profits. The benefits are easy enough to understand and grasp.

Yet if only it were so simple to figure out your solution’s pricing sweet spot.

For B2B companies — especially those in the software and service sectors — the environment has changed dramatically in the past 20 years. A rapidly changing marketplace introduces a new level of pricing complexity.

Many B2B organizations must grapple with the shift from license contract models to subscription models. Additionally, the global marketplace has seen an influx of software providers and rapid-growth startups. Jay McBain, principal analyst at Forrester does not see this trend going away: “I estimate there are more than 100,000 software companies (ISVs) today around the world — up from 10,000 only 10 years ago. I wouldn’t be surprised, with the level of hyper-specialization new buyers are demanding, to see that number grow to 1 million by 2027.”

With all this change, what should you do with your pricing strategy — and what would best serve your buyers? We sought answers to these very questions and came away with pricing principles that would stand the test of time, even in a chaotic marketplace. We are excited to share what we learned here.

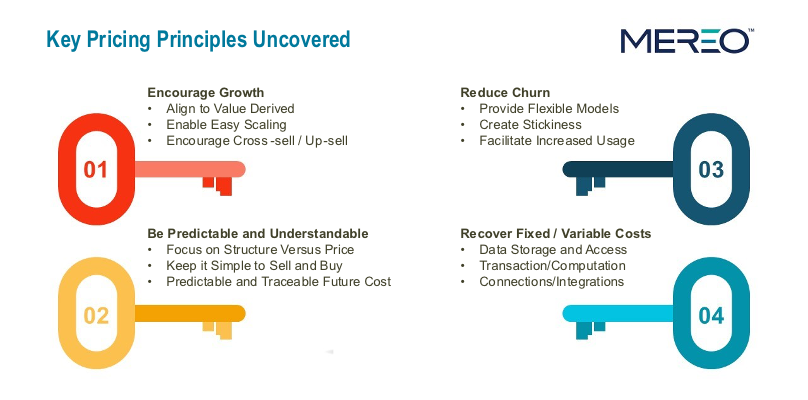

Integrating Key Pricing Principles

Our solution management experts at Mereo independently researched 20 B2B software companies, including application and platform providers. We complemented our online research with 15 in-depth buyer and seller interviews focused on C-level executives that procure and sell software, as well as product management and sales executives of software providers — representing the spectrum from SMB to enterprise companies.

After digging into the biggest challenges, solutions and outcomes for our participants, we yielded four key pricing strategy principles every software provider — and software buyer — should consider.

Encourage Growth

Encourage Growth

As obvious as this seems, we found numerous examples of pricing models that in fact discouraged user growth and adoption. Your pricing strategy must encourage growth.

The best pricing approaches:

- Align the pricing to the value the software delivers

- Simplifies scaling as the business requires

- Is packaged to encourage initial adoption as well as cross-sells and up-sells of new features and associated modules

Be Predictable and Understandable

The number one pricing factor raised by buyers was the ability to predict costs now and in the future for the solutions they procure. Interestingly, sellers felt the same way; they did not want models that create buyer confusion and objections to closing a deal.

As part of aligning to this principle, think in terms of pricing structure versus the price itself. Keep the structure simple to understand for the buyer and seller, and consider how predictable it will be for you as a vendor and them as a buyer. Can they see how the future costs would be impacted, for instance, by a merger, acquisition or other growth strategy?

Reduce Churn

Sellers must make it easy for buyers to remain a customer. Providing flexible models for consuming the software from both a technology and pricing approach (e.g. modules, users, transactions) is critical, but, as a provider, you will also want to think about what will make your solution “sticky” in the long-term. For example, a seller could provide built-in concierge service for specific tools to ensure they are rapidly deployed. The strategy varies between solution, market and customer, but is important to consider from the onset.

What feature or capability do you need to ensure is rapidly and fully adopted that will create a desire to continue using the solution? How do you encourage that usage?

Recover Fixed and Variable Costs

Providers, especially those in rapid-growth mode, often talked about the “surprise” factors associated with using third-party hosting services (e.g. Microsoft or Amazon Web Services). These providers had not considered all the associated costs related to storage, transactions, integrations and more. As such, they often were put in a position of having to go back to customers upon renewal with significant cost changes.

No buyer wants to be surprised by data and storage charges, unexpected transaction fees or costs of integrations to other mission-critical systems (see Principle 2). Do your up-front research and do it well to make this part of pricing transparent to the buyer. Also, consider approaches that allow you to recoup these environment charges early to reduce cost absorption risk on your business.

Explore how our pricing solutions and guidance have supported a new and growing software provider!

Choosing the Right Foundational Pricing Model

Out of our same research, we discovered three common pricing models.

Outcome-based Pricing

The solution is priced based on the outcome the buyer may realize. This model is also referred to as “value-based pricing” or “cost/revenue sharing.”

While this model is discussed now and again, it is rarely adopted as:

- Buyers do not want to share their gains

- Sellers do not want to go through the trouble and lack of visibility to predictability of trying to track buyer metrics for billing

Consumption-based Pricing

The solution is priced based on how much of something the buyer consumes. This is a common choice for apps, transactions, storage, endpoints, flows or kilo-characters.

This approach has:

- A neutral growth impact as it is typically transaction-based (think EDI)

- Predictability for point solutions but generally not for broader solutions like ERP

- Potential to turn off a buyer after the sale if the metric and pricing are not visible

- Positive outcomes for sellers when the cost model is also consumption-based

User and Module–based Pricing

The solution is priced based on the number of users (named, concurrent and/or type) purchased and/or number of modules purchased.

This approach offers:

- Predictable cost impacts associated with usage and growth, which are easily measured and forecasted for the buyer

- Alignment to the consumption and value delivered by the seller

- Ability to be designed to encourage use of specific capabilities that drive adoption and stickiness

- Cost recovery of environment setup and maintenance reducing margin risk in the short-term

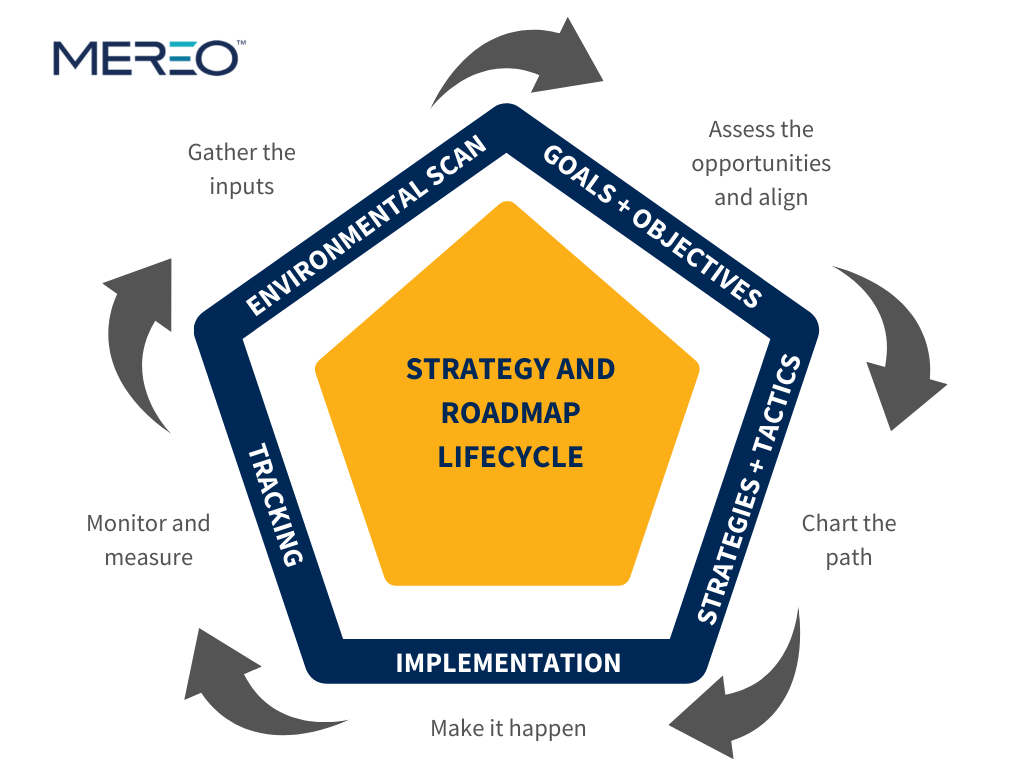

Uncovering Your Ideal Pricing Strategy

Considering the high-level pricing principles and approaches in the context of application pricing, platform pricing, packaging, contract terms, training, services, support and SLA’s is a daunting task. Successful companies align pricing strategies with their differentiated value proposition to accelerate deal negotiations and contract closing.

At Mereo, we can help navigate these complex and multi-faceted elements with your team to build the right pricing approach for you. We would be happy to schedule time to review our findings with your organization and explore how you can accelerate your revenue performance. Fill in the form below, and a solution management expert will be in touch to set up a time to talk.