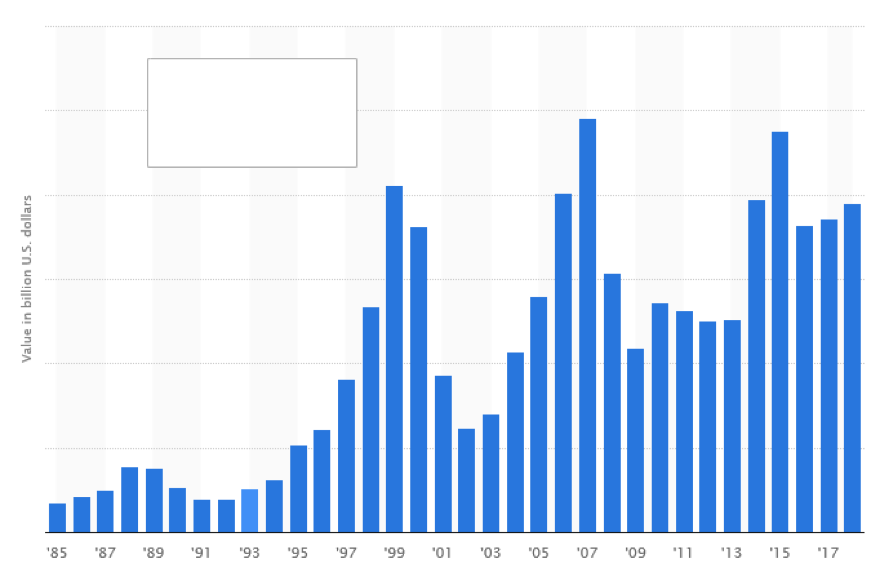

In February 2019, Airbus announced it would stop the production of its A380 jumbo jet by the end of 2021. This comes after just 10 years in production and with more than an estimated $16 billion invested in the development with no profit to show — and rather a hefty weigh on their company financials.

Business solutions fail all the time. What makes this particular case study fascinating is how much the failure stemmed from an ineffective solutions strategy starting in its initial input and process to the delivery, launch and ongoing governance, or lack thereof.

Make sure your seat belt is securely fastened as we dive into the Airbus A380 case study, and in event of emergency, scroll to the bottom of the page to learn more how Mereo can help.

The Initial Airbus A380 Strategy Input and Process

More than 40 years ago, Boeing introduced the 747 jumbo jet to market. It had experienced success but by the early 2000s, Boeing had taken note of where the market was heading and started developing the 787, utilizing new technologies and fuel efficiencies, to serve its market.

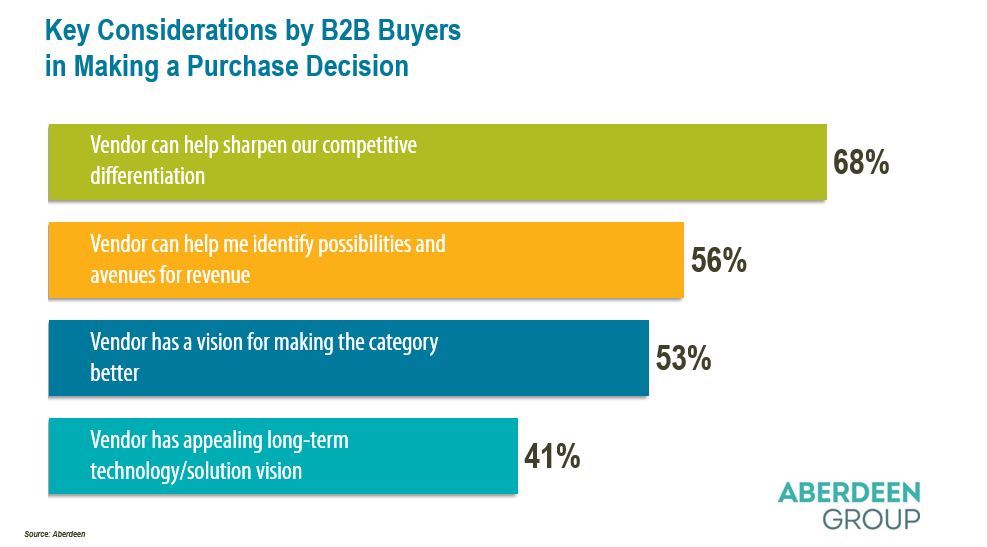

Cue Airbus, and at the same time it either missed the mark about where the market was heading or its business strategy demanded that it must offer a competitive offering to Boeing, to prove Airbus could create a product just as good or better. Regardless of the reason, the Airbus A380 jumbo jet was put into motion — at least 10 years too late — pressing forward without a seek to serve mentality.

From the start, the foundation of the A380 was on rocky ground, with a misaligned business strategy and corporate structure, including co-CEOs in France and Germany who ended-up failing to work in collaboration on critical aspects of the production and software systems.

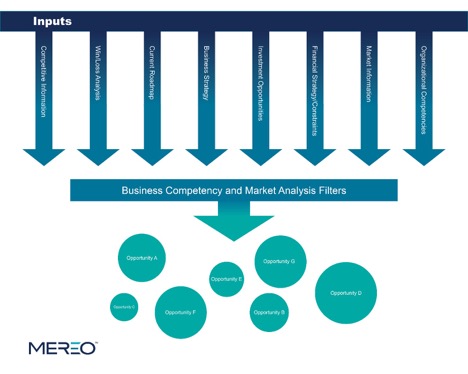

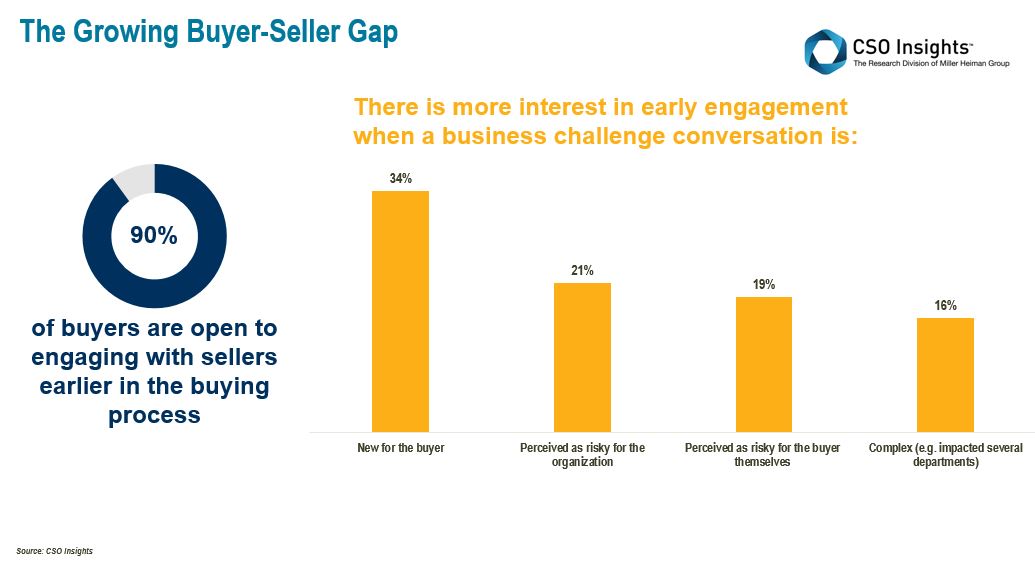

What could have saved Airbus at this point from this massively delayed, costly, short-lived jumbo jet solution would have been an initial business competency and market analysis validation as the solution strategy was being developed.

At Mereo, we ask companies to consider and answer eight internal inputs prior to committing to a project. Do all these inputs need to be positives? No. Some may be challenges that the company can realize from the start and work around with alternative solutions. For example, if a company can be honest with themselves about their lack of organizational competency, they can find a partner company who can help fill in the gaps, saving them time and money in the end, and creating a better solution all around.

In the case of the Airbus A380, there were a number of inputs that were either ignored or that were overridden by the business strategy, including market information, organizational competencies and competitive information. Notably, Airbus had underestimated the complexity of the wiring and software centers, and engine and wing quality issues continued to delay the project, increase its costs and induce bad press.

The other aspect of the analysis that appeared faulty was external validation. Did Airbus look to its market to ensure the A380 would truly serve their needs? Emirates became a key customer, but Airbus traditionally serves the European market, and Lufthansa is the only European customer to purchase the jets, buying just 14 A380s. The A380 was quickly unappealing to many airports because the taxiway and gate infrastructure of the airport itself would need to be changed to accommodate this behemoth. Though passengers liked the spacious design and luggage handling, airlines worried about filling 500+ seats per flight.

This project seemed to have stemmed from a place of emotion and corporate pride to compete with a competitor who was already moving on to the next big thing, which ironically came in a smaller package. Was the Airbus A380 a technologically excellent achievement? Yes. But its market viability is dubious, and that can be further seen as we explore the ongoing delivery and execution.

The Ongoing Delivery and Execution of the Airbus A380

The Airbus A380 was many years late to market. Executives blamed the economic crisis and production issues for the late delivery in 2007. Yet it was more than this that was keeping Airbus from reaching its goals.

For a solution to be successful, there must be alignment across four plans within the organization: business, solution strategy, financial and go-to-market. Airbus was struggling across the board.

- Business: The overall business plan was failing in market growth, deliveries, performance and competitiveness.

- Financial: Performance was poor due to the cost overruns and poor revenue and delivery performance.

- Solution Strategy: This was missing the mark, was late, and competing internal strategies were already underway.

- Go-to-Market: The launch was late, there was under-delivery and a lack of input to ongoing strategy.

What could have saved them would have been a formal governance process, where they could have seen they were unable to check the necessary boxes and would have been able to stop, make significant changes to plans to improve market uptake or cut losses.

Yet either this governance process did not exist or the culture to step up and speak up about these clearly visible issues was unviable. And that lack of honest governance added-up to $16 billion in costs, well over their $6 billion goal.

By the time the Airbus A380 was going to market, they had already started developing a competing product, the A350, which was more in line with Boeing 787 fuel efficient, smaller jet with a focus on serving regional destinations without a need to feed a congested airline hub model. This regional service would prove more cost effective and would drive higher customer satisfaction.

The execution became the next area of failure. They did a big launch of the product. When you look at the launch, you have to ask if they executing on the launch plan (satisfaction, market uptake, on-time deliveries, production ramp, etc.)? And you come back to again what are the key metrics that define success and are we achieving those metrics? Airbus clearly was not. But no one pulled the plug in time to reallocate resources to the more important A350 project.

All Solutions Face Issues At Multiple Junctures — What Matters Is How You Handle Those Challenges

The Aribus A380 should have never been green-lighted when it was. For your solution to be viable, it needs a market that would find it valuable. Your solution must be serving a buyer’s need.

Even if the market was ripe for the A380, the issues with the Airbus A380 solution management strategy are not unique. With this many moving parts and people, issues arise. In all cases, what is needed is a process and culture that can spot those issues, start data-driven questions and conversations, and react accordingly.

Airbus may have lost some money and some credibility if they pulled the plug on the A380 project midway through production. Yet, they could have stood by their decision with objective market, industry and financial facts to back it up. They could have put out their A350 better and sooner.

Because for every single minute you spend on one thing is a minute you cannot spend on something else. And if you spend those minutes on the wrong thing and don’t call it when it is clearly wasting resources, you will never be able to get those back.

Do Solution Management Right

At Mereo, we help companies align their business, validate their solutions and govern their processes to avoid failures like the short-lived, financial burden of the Airbus A380. Contact us to learn more.

Solution Management