While companies prepare for the “Revenue Rebound” as the coronavirus pandemic evolves and eventually slows, I turned to my team of Mereo principals to ask: What industry and organizational changes from this unprecedented disruption do you foresee remaining?

Here are their expert insights:

Supply chains will react with — and stick to — a new normal of heightened security and multi-sourcing

Supply chains have faced significant disruptions and shortages from the coronavirus pandemic. In the short-term, governments and business leaders have been scrambling for quick fixes to these major issues. But the mid- to long-term strategy demands a new normal that overhauls the status quo of pre-COVID-19.

No longer will cheapest be the name of the game. Governments and businesses are going to be focused on security of supply (aka supply chain continuity). This is particularly vital for healthcare, critical technology and military industries. Entities will look beyond cost to ensure flexibility and agility of their supply chains.

Flexible supply chains will result from replacing sole sourcing strategies with multi-sourcing strategies. Raw material and finished goods inventories will increase to protect the continuity of supply. Organizations will not be looking to offshore, especially with critical goods, as much as they will be focusing on regional-based manufacturing and supply chain strategies that serve local customer bases. And the software solutions — which enable the supply chain optimization, rapid adjustments, scenario game-planning evaluation, and near real-time communication and visibility — will increase in demand and value.

The overall integrity of supply chains will grow in importance. In our hyper-sensitized culture more aware than ever before of risks, it has to. Government regulations and focus on ingredients and quality will heighten, resulting in inherent enhancements for those who wish to remain marketable. Monitoring and control of imitation and fake goods sold via ecommerce will increase, threatening counterfeiters and dishonest sellers (and potentially the distributors) with major financial penalties (we will see more of Amazon’s recent lawsuit).

Those in the industry used to playing “Lean” and JIT (just in time) supply principals will need to align their designs to the new post-COVID-19 reality of integrity, control and security.

— Joel Reed

Learn more about Joel Reed and view his recent posts here.

Organizational leadership will face a recurring pressure to adapt rapidly — or fail

The mid- and long-term effects of the current global pandemic have yet to show their true numbers. The economic impact on major industries will continue to ripple out, disrupting supply chains, advancing bankruptcies and entirely reshaping the very nature of how business is done.

While there is still much left to be learned, one thing is clear — this will not be the last major market disruption business leaders will experience. This crisis environment and sweeping changes will likely become a recurring theme. Organizations and industries with leadership prepared and willing to adapt will succeed. Those who fight the change and stick to the status quo will be shuttered for good.

Regardless of no one wanting to hear it, it is true: Our industries and markets will never be the same. Plato said, “Necessity is the mother of invention.” Leadership around the world have started to and will continue to rethink how business is done — from manufacturing, distribution and supply chains, to service delivery and remote work.

Innovative leaders and organizations will thrive, and new cottage industries will emerge to take the place of aging or dead ways of doing business. Specifically, we will see major competitors to Amazon. We will see a monumental rise in home delivery over brick-and-mortar shopping and dining. Commercial real estate must pivot in response to a new norm as demand for large gathering spaces will continue to weaken.

Organizationally and internally, leadership must adapt traditional office norms to virtual work-from-home teams. Technologies that enable virtual environments, including AI, will increase in demand and output. Organizations are implementing digital tools at a rapid rate to enable personal and professional collaboration. Long live the virtual happy hour.

And with unemployment at unprecedented levels, leadership now has access to new talent that will be hungry for work. Leadership can take advantage of this time to improve its talent pool and weed-out any employees unwilling to or failing to adapt to the changing times.

In all, for leadership to stand tall into the uncertain future, they need to be proactive: Diversify revenue streams and implement technology now to enable your organization into the future. They must be balanced: Rethink traditional work environments, supply chains, physical spaces, and be ready to handle the “old normal” and “new normal” in equal measure. And they have to be innovative: Rethink and rebuild your business model, business processes, M&A strategies and technologies to enable greater flexibility and responsiveness to whatever the future brings.

— Steve Maegdlin

Learn more about Steve Maegdlin here.

Online retail will be commonplace — while customer appreciation of personalized service and interaction will be at an all-time high

While online shopping has been steadily growing and gaining traction over the past several years, the COVID-19 crisis is going to create step function change in the move to online ordering — and it is going to permanently change the way customers want to interact with brick-and-mortar retailers. Companies such as Ace Hardware are seeing online ordering reaching volumes not originally forecasted to occur before 2025. At the same time, retail outlets are redefining the customer interaction in ways that will be here to stay even when the immediate crisis is over.

After COVID-19, customers will continue to expect a seamless experience between their online and store-based experience. All retailers are going to be forced to figure this out or risk declining sales and market share. The crisis is compressing the urgency into a matter of weeks or months versus the years it might have taken to get this right. The concept of curbside pick-up will be here to stay, enabling the customer to get what they want quicker than before. Also customer expectations for delivery of virtually any product or any order size will continue after the crisis has averted. Brick-and mortar-retailers — particularly those with many locations — are in position to potentially capitalize on these trends versus mega-retailers like Amazon, Walmart and Home Depot where there are fewer locations, which means more distance from the end-customer. The positioning of inventory close to the consumer can be a strong advantage if retailers figure out the seamless online-to-store experience.

Conversely to all of this, there will also be renewed appreciation by a segment of the population for personal interactions and personalized service after the COVID-19 crisis is over. Many people have been starved of human interaction and will be grateful when retail employees go above-and-beyond to answer questions or solve problems. Retailers whose business models rely on brick-and-mortar locations should not skimp on their investment in employee training both in terms of product expertise and customer service skills. Great service will also permanently extend to new dimensions as a result of the crisis including over-the-phone service, online chat service, and delivery service and experience.

In summary, the retail industry is being forced by this crisis to change very quickly. Those who can discern the lasting trends and perfect their new processes will stand to grow and thrive. Those who do not will decline after the crisis is over.

— Andy Carlson

Learn more about Andy Carlson here.

Marketing must prioritize activities that will help their organization maintain consistent brand promises amid these evolving times

Given the economic climate, marketing budgets will face the threat of being slashed. Yet companies are facing one of the greatest disruptions in their histories. Marketing activities will be vital to ensuring lights remain on and brands stay relevant.

Companies will need to get creative and prioritize which marketing activities will make the greatest impact to the sales funnel. Online advertising, social selling, search marketing and virtual events will be key. Marketers who can effectively track efforts and share results in compelling ways tied back to revenue will keep their department relevant. They will get bonus credit for being able to show how investments in marketing now will impact the current and future quarters, even at minimal spends.

Marketing professionals will face greater pressure from audiences to up the ante for more personal, more relevant and more engaging content. Real-time data and attribution modeling will help inform pinpointed executions and adjustments. Virtual events will become commonplace, and attendees will expect a high level of quality and experience. And building credibility in a growing virtual environment will mean inviting your customers to participate in your marketing programs. Gather testimonials. Forge partnerships and advocates. Create vlog case studies. Your marketing will stand out and above.

As always, it is vital for marketing to keep a pulse on the market now and into the future. Scenario planning and market research have taken on a new level of importance. Marketing departments should plan for new customer pains, new target audiences and emerging markets.

For any of these marketing efforts to make a true impact on organizations’ bottom lines — to help carry them through this pandemic and rise-up onward — marketing must align with leadership and other departments. Share plans and come together. What products and services will need investments based on market research and predictions? What are the new target buyer priorities and details?

The past norms before this pandemic are bygone, but new opportunities are fresh for the picking to those who strategically plan and push forward.

— Carolyn Layne

Learn more about Carolyn Layne and see her posts here.

Salespeople will need to master their trade, if not already, and look to inside sales for success

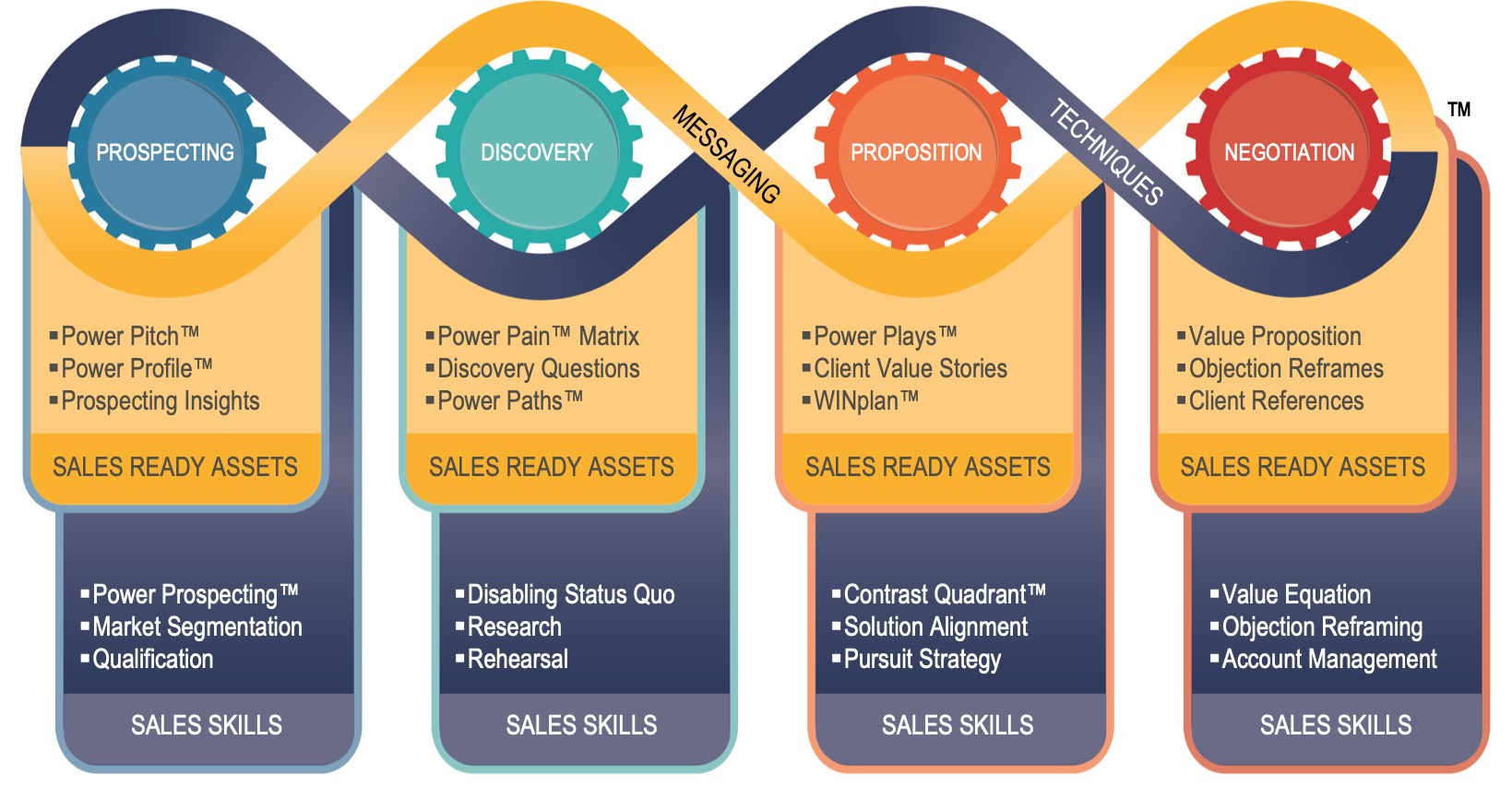

As many in the industry have been discussing the lasting impacts of the coronavirus, a key point often goes unnoticed — now more than ever before sales teams need to excel at the skills of the trade. A special focus must be put on identifying competency gaps as soon as possible and closing them.

Salespeople are facing a tenser economic climate, higher risk aversion and cost consciousness across industries and sectors. Today’s and tomorrow’s buyers will be seeking out salespeople who have mastered all the levels of sales excellence — who hold steady with an authentic and consistent Seek to Serve, Not to Sell sales style in the shaky wake of this crisis and any to follow.

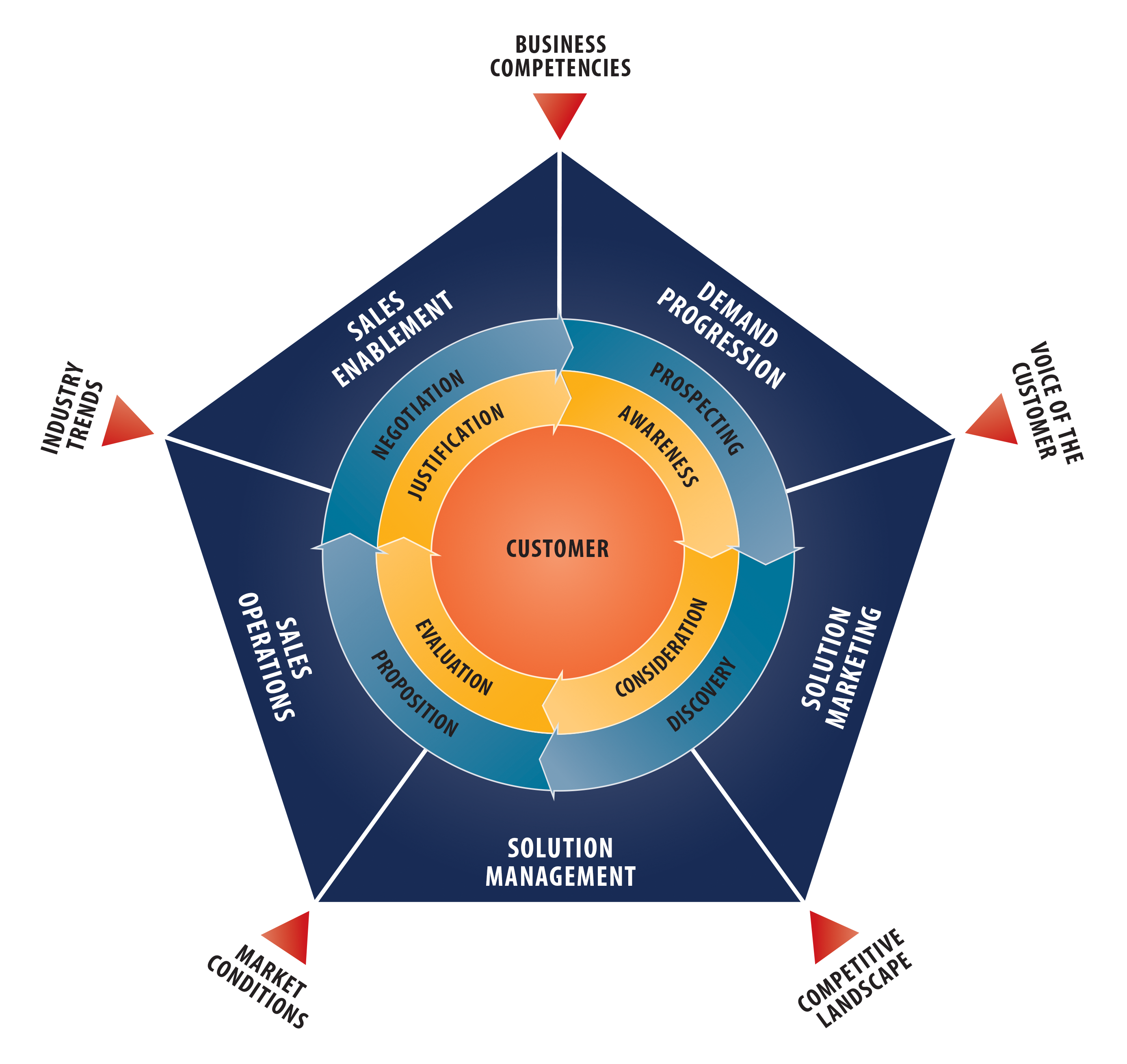

This back-to-the-basics sentiment extends beyond salespeople and their individual skills alone. Sales leaders must adapt their sales excellence framework with a clear sales strategy, a solid sales management system and a sales enablement plan to ensure the right new buyers are targeted and engaged with valuable dialogue throughout the whole buying process.

For sales teams as a whole, the crisis has forced sudden remote work between customers and colleagues alike. In this context, the capacity of the sales manager to maintain contact with all team members and really care for them has been crucial. The proximity between the manager with their staff is a well-recognized parameter of sales rep motivation and performance. It does not mean that it is always a reality. The sanitary crisis has made this parameter even more visible and one can expect that, on average, it will receive a higher attention than before.

Additionally, the extended phase of travel restriction and reduced face-to-face interactions will further boost the development of inside sales beyond transactional sales to small customers. There is still a broadly accepted myth that inside sales does not allow you to build, develop and maintain a relationship with customers. Yet at Gartner, which does not sell a commodity, many customers who spend five figures yearly on research reports and events are managed in fact through inside sales. This framework has not prevented Gartner’s account managers from developing deep knowledge of their customers and forging real relationships with key contacts. And post-COVID-19, more companies will realize that they can leverage inside sales in a similar fashion with great results.

— Olivier Rivière

Learn more about Olivier Rivière here.

Sellers need to speak to healthcare and government buyer struggles with novel pains that are continuing to evolve rapidly

We all have had a front-row seat to the structures of both healthcare and government crumbling beneath the massive and sudden weight of COVID-19. Hospitals prepared to be overwhelmed with patients. Elective procedure revenues disappeared. State and local government processes and controls have been tested in a new work-from-home environment.

For healthcare, a myriad of new organizational priorities for buyers are demanding attention and taking it away from others common in the past. Buyers’ traditional revenue streams have been disrupted with devastating impacts to the industry overall. As such buyer motivation has turned specifically to identifying and enabling new revenue streams such as with telehealth, and reducing costs. This is no short order from buyers for B2B organizations to serve.

With local and state governments, buyers are facing a whole new world. There is greater distraction with work-from-home issues that need addressing, fast. Their processes and priorities are being stress-tested, and frameworks need to be revised and re-written. Budgets shortfalls are anticipated, and B2B selling organizations who serve state and local government need to be prepared with relevant messaging that prioritizes solutions that make a big impact on a small budget.

In all, like with other industries after the COVID-19 pandemic but at an even greater depth, healthcare and government buyers are suffering from new and highly specific pains. B2B organizations who can answer those with compelling solutions on the buyers’ evolving terms, will stand out and win.

— Andy McGuire

Learn more about Andy McGuire here.

New buyer trends that are here to stay mean sellers need to overhaul their go-to-market strategy

With the “new normal” of post COVID-19 not yet in focus, let’s all remember the adage from Warren E. Buffet: “It’s only when the tide goes out that you learn who’s been swimming naked.”

In that vein, post-COVID-19 buyers may soon see which sellers need a new swimsuit. So, while COVID-19 waves will hopefully soon lessen, three specific buyer trends are taking form — with some already making waves — that will accelerate and alter how sellers must go-to-market.

Remote work makes the buying committee even more disconnected. As remote work becomes standard (along with barking dogs and Zoom meetings that look like Grateful Dead concerts), access to buying committees and key decision makers is even more challenging. Sellers must now plan better and execute smarter and better-coordinated revenue pursuits.

Risk management moves front and center. The painful spectacle of business cycles that grind-to-a-halt makes risk the No. 1 lens through which buyers scrutinize seller promises. Sellers must demonstrate clear proof — validated with hard data — and flex even more to structure low-risk, high-return deals that produce results from day one.

Value reigns. While the market shakeout will clear the field of many vendors, it does not translate to dropping noise levels. Marketers have already cranked their dials on campaigns using the latest in automated MarTech tools. Noise filters will tighten — and only seller messaging with a crisp, clear value proposition will gain buyer awareness.

The takeaway? If your sales revenue was unpredictable or faltering before the COVID-19 tide went out, now may be a good time for a new swimsuit. Consider a refresh to more-compelling, business-value-focused messaging that breathes life into sales playbooks.

— Bill Watson

Learn more about Bill Watson here.

What changes are necessary for your organization to remain competitive and thriving? Connect with us to talk strategies for best seeing those through for sustainable revenue performance post-coronavirus.